When letting our homes we allocate according to bedroom need to make best use of our housing stock and avoid under occupying. We apply the Local Housing Allowance (LHA) size criteria to bedroom need.

The LHA size criteria allow one bedroom for each of the following:

- Adult couple

- Any other adult (aged 16 or over)

- Two children of the same sex under the age of 16

- Two children under 10 regardless of sex

- Any other child (other than a foster child or child whose main home is elsewhere)

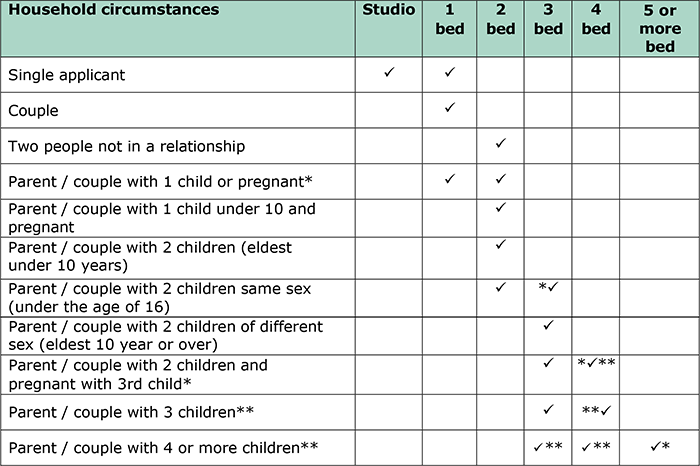

Below shows the size of property a household can be considered for:

- Single applicant - Studio / 1 bed

- Couple - 1 bed

- Two people not in a relationship - 2 bed

- Parent / couple with 1 child or pregnant* - 1 bed / 2 bed

- Parent / couple with 1 child under 10 and pregnant - 2 bed

- Parent / couple with 2 children (eldest under 10 years) - 2 bed

- Parent / couple with 2 children same sex (under the age of 16) - 2 bed / 3 bed*

- Parent / couple with 2 children of different sex (eldest 10 year or over) - 3 bed

- Parent/couplewith2childrenand pregnant with 3rd child* - 3 bed / 4 bed* **

- Parent / couple with 3 children** - 3 bed / 4 bed**

- Parent / couple with 4 or more children** - 3 bed / 4 bed** / 5 bed*

* May be accepted for additional bedroom (at our discretion) but advised of the bedroom tax and how they will be affected if they are claiming benefit now or in the future.

** Dependant on age of children – Apply LHA criteria

Separated parents who share childcare may be allocated an extra bedroom to reflect this, can be affected by the Spare Room Subsidy Rules (Bedroom Tax). Benefit rules mean there must be a designated ‘main carer’ for children (who receives the extra benefit).

Under Occupying

Since April 2013, the Spare Room Subsidy (Bedroom Tax) means that working age residents who under occupy their property have the housing element of any benefits reduced by:

- One spare bedroom loses 14% of the entitled benefit.

- Two or more spare bedrooms loses 25% of the entitled benefit.

Under occupancy is also measured by the Local Housing Allowance size criteria. If we approve a letting outside of the LHA criteria it is at the discretion of the Lettings Manager.

Examples of when we may allow this are:

- a parent/couple with 2 children (same sex) and pregnant with a third child – LHA size criteria would consider household eligible for a two bedroom property, we may allow them to move in to a 3 bedroom property

- a parent/couple with two children of the same sex (aged 10 and 15) – LHA size criteria would consider household eligible for a two bedroom property, we may choose to allow them to move to a three bedroom property due to the eldest child soon turning 16 and qualifying for a separate bedroom

- a property is hard to let

- when assisting an existing resident to downsize (we may allow under occupation but in return freeing up a larger, much needed home)

- where a Sovereign resident has been asked to move because their home is being disposed of or redeveloped.

In situations like this we consider our customers’ circumstances, can they afford their rent if they under occupy the home and are any other benefits impacted.

Additional bedrooms

An additional bedroom will be allowed if:

- a child or non-dependent adult requires overnight care from a non-resident carer(s)*

- a couple or children cannot share because of a disability or medical condition

- rooms used by students or members of the armed forces are not counted as ‘spare’ if they’re away and intend to return home. Professional evidence for medical reasons, will be required from a suitable professional, such as a Doctor or Occupational Therapist.

Guidance to customers

Customers will be advised of the Spare Room Subsidy (Bedroom Tax) and how they might be affected.

If the customer chooses to go ahead with the move after being given advice that they will be affected by the Spare Room Subsidy Rules (Bedroom Tax), we will record this advice has been given on the Pre Tenancy Assessment.